Streaming wars or content competition?

According to the media, the launch of Disney+ streaming services this week spells the beginning of the video streaming wars. Prior to the launch of Disney+, we would hear of Netflix as the main streaming service. Yes, you’d think of Hulu or Sling; but these were more as alternatives to cable TV. They made access to cable and terrestrial channels easier and cheaper.

But the media is misguided in this misplaced debate. Let me tell you why. If we are to try and debate or strategically analyse “streaming services”, we’ll get our heads in such a spin that we won’t know what is up from down; front from back! Streaming is so broad in what it covers. Streaming is essentially the digital distribution of audio-visual content direct from the internet; direct, not downloaded and watched later. It is the antithesis of those days when the only moment a parent could spend with a young teen, was as s/he was walking around waiting for a movie to download off the internet.

However, the true definition of streaming makes for unwieldy strategic analysis. Yes, we have the traditionally defined streaming as services like Netflix, Hulu and Amazon Prime Video. But cable channels like HBO and Showtime are already streaming. As are specialist subject matter owners like DC Universe comics. By definition, even watching CBS News or Citizen TV Kenya direct, off the internet, is streaming.

Lack of clear definition.

What are you talking about?!

Redefining streaming wars

Content crusades

I learned a long time ago that in strategy, you must first define the correct issue/ challenge/ focus area for it to be effective. This battle following the launch of Disney+ will not just be about streaming. Streaming services have been in existence for more than a decade now; so it’s nothing new. This will be a content competition for consumers’ hearts and minds. It is erroneous to think that this is about anything else. Streaming is simply the vehicle for more efficient, cheaper, customer controlled content delivery.

Prior to the launch of Disney+, the streaming also-rans like Hulu, Amazon Prime Video (yes, I called Amazon an also-ran) and others, were niche providers. You’d be hard pressed to think of any programming they carried, or anyone subscribing to them. However, almost everyone you knew had, or had access to Netflix. Many content owners, including Disney licensed their content to Netflix, contributing to its dominance to 165 million subscribers. Netflix even held the licenses to shows like ‘Friends’ and ‘The Office’. Netflix will now lose those shows to HBO Max and Peacock respectively.

The Disney+ entry has caused such a huge media splash, because of dominant content credentials, not superior streaming technology. In fact, the technology problems around their 12th November 2019 launch demonstrated that theirs is not about technology expertise.

In my stubborn youth, I would have insisted on using the correct terminology other than the misnomer ‘streaming wars’. However, since the term is lingua franca, I will, in this piece, use ‘streaming wars’ when referring to content competition. This having clarified the true reference and meaning of the term. I repeat, streaming wars = content competition to win consumers.

The main protagonists

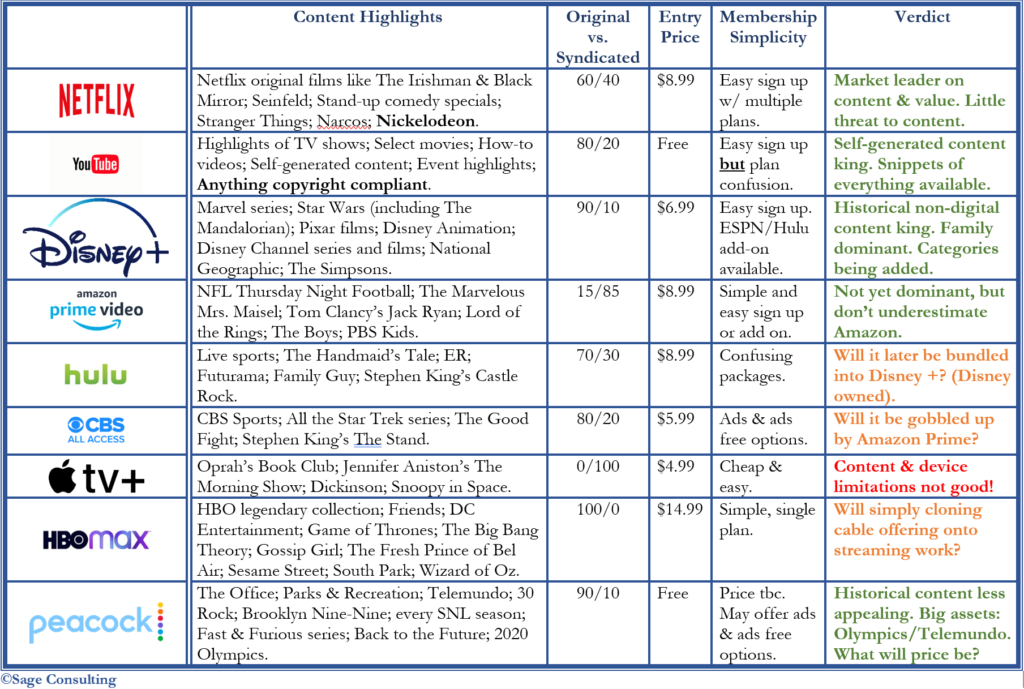

Some US research has indicated that the average consumer would be willing to subscribe to up to 4 streaming services, depending on price and the availability of their favourite shows on the various services. https://today.yougov.com/topics/media/articles-reports/2019/10/30/how-many-streaming-services-are-americans-willing-. So given these indications, let’s look at those services most likely to be part of the short list of consumer choices.

Potential also-rans

The convention is to usually begin with the winners before losers. But in this context, the point is best illustrated by first looking at the potential also-rans.

The term ‘chasing shadows’ at best means unsuccessfully competing with someone better than you. At worst, it means to try to achieve something that is impossible, or doesn’t exist. Because the following players don’t appear to have understood the game, that is what they are doing.

Apple TV+: likely not to survive

Apple represents the classic case of a misguided understanding of the strategy in this game. But I guess, its hard to teach an old dog new tricks. After Apple’s home run hits with the iPod and iPhone, they probably thought that the streaming wars were once again about technology. Thus, Apple TV+ is a platform without it’s own content, and hoping to survive on their proprietary device linked technology. But content is not part of Apple’s core competency. So, they’re in a race where they are in way over their head. However, it’s a catch-22 for them, because they are damned if they do, and damned if they don’t! They can’t continue to be a one trick pony with the iPhone, but where do they go to next?!

Hulu & CBS All Access: likely to be absorbed

Hulu is owned by Disney, and CBS All Access is already bundled into Amazon Prime membership. So, why do they need to stand alone? Given the research, Hulu and CBS All Access are less likely to be part of the consumer repertoire of up to 4 services. Would they therefore be more beneficial to Disney and the CBS Corporation respectively as standalone’s, or would it make more sense to bundle them with a bigger service? Hulu already duplicates areas of the Disney+ offering, such as live sports from ESPN, and family programming; so why maintain an additional cost centre?! The CBS All Access bundling on Amazon Prime could be focused on by the CBS Corporation as a tidy cost-centre-free revenue stream, through licensing fees. And CBS All Access’s content assets, like Star Trek and its live sports, could in return give Amazon Prime Video a very nice bump.

HBO Max

HBO Max has simply duplicated their cable offering, and made it available through streaming. Additionally, they’ve placed a big gamble on investing in the ‘Friends’ library to add value to their streaming content. However, if you look at this content, it’s mainly hit programming from the past. This business model is at best likely to be a zero sum game. People will not subscribe to the cable channel and pay the exact same amount to subscribe to streaming. Some subscribers will transition from one to the other, and they’ll gain some new subscribers with their strongest content assets. But they may also lose some subscribers in the transition. Nonetheless, their biggest drawback is that their strongest content like ‘Friends’, ‘Game of Thrones’, ‘The Sopranos’, etc., is neither new, current nor live. The zero sum game may give them a base of subscribers, but is likely to lead to declining revenues for HBO overall.

The strong: content strategists

So, this now brings us to those services likely to end up for serious consideration on the consumer repertoire.

As mentioned at the outset, these are the players who get it. It’s not simply about streaming wars, but about being strong in the competition for content.

Netflix and Disney+: the conventional streaming leaders

Netflix currently holds first mover advantage with 165 million subscribers and being synonymous with streaming. Even Disney+, with its strong content assets, doesn’t expect to get to half that number of subscribers within the next 5 years. Many may see the streaming wars as these two services going hammer and tongs against each other, but I see it differently. I can see the two carving out their different niches, and somehow establishing a balance of co-existence. Given the research referenced above, at $8.99 for the Netflix entry package, or $12.99 for it’s main package, and $6.99 for Disney+, it would fall within the $21 minimum budget that 37% of Americans say they’d be willing to lay out, per month, for their streaming services. So, consumers could theoretically afford to carry both services. But of course, as in any market competition, there will be levels of poaching of each other’s subscribers. Netflix has thus proactively formed a partnership with Nickelodeon to shore up its family offering, which is the Disney+ area of strength. https://techcrunch.com/2019/11/13/netflix-and-nickelodeon-partner-on-original-programming-following-disney-launch/. However, I still maintain, there is enough room in the marketplace for both.

Netflix and Disney+ will be the unassailable market leaders. However, each will have to adapt their business models to adapt to the competition from the other. That is the nature of business. While Disney will for the first time be playing catch up and not be the market leader, Netflix will strive for international market growth, to shore itself up against the competition’s inroads into its US subscriber base.

YouTube: a different kettle of fish

YouTube is in the unique position of not only being a streaming service, but also a social media channel. The game changer in the digital age has been ordinary citizens being able to generate their own content. Not only is YouTube in the same league as Facebook, Instagram and Tik Tok on social media, but also in the league of Netflix and now Disney+ in streaming. There is currently no other entity playing in their dual-threat space.

Amazon Prime Video

As I’ve said in so many instances, never underestimate Amazon. The analytics that they collect on consumer mindset and behaviour will always give them an advantage. Additionally, they have no fear of acquisition, and will go and get the content they need, as necessary. Amazon’s track record shows that they hold the long view, prioritise brand sustainability, and aren’t afraid to dip into their deep pockets to drive these objectives. They will invest if it builds their brand sustainability. https://bizlifesmarts.com/brand%20sustainability. For now, Amazon is so ubiquitous in our lives, that you’ve got to keep your eye on their streaming offering.

However for now, since streaming is not at this time a major playing field for them, they will simply sustain the platform to complement their other offerings. If they do by chance decide to give streaming services more focus, it would catapult them alongside Netflix and Disney+.

Peacock

Yes, you’re wondering what Peacock is. It will only launch in 2020 and is the offering from NBC Universal, and the name obviously derives from the NBC logo. As a late comer to the game, they have an ingenious strategy. They are locking down the Latino market with Telemundo, and using major events like the Olympics to draw in subscribers. Their other content offerings aren’t too shabby either, although their main drawback is that it is past programming. We’ll wait to see if they’ll get their pricing right. Word is that they are considering two options: An ads-driven, free option; and an ads-free, subscription option. The synergies between Peacock and the terrestrial NBC will work well.

The Dark Web: Contending with unauthorised streaming apps

In this digital era, companies must always contend with unauthorised users of content. Myriad unauthorised streaming apps exist, that are streaming the content owned by the major players. The question is the scale of the problem. On the downside, the legitimate players are confronted by a piracy problem, that they must decide if it is worth the cost of clamping down on. On the upside, since it is the blackmarket, these streaming apps cannot promote themselves, and likely won’t go into wide circulation; nonetheless, they are still stealing revenues from the legitimate content owners. It is an issue that is difficult to address, and I must admit that I don’t know what the solutions are.

Final Verdict

If you look at the streaming services landscape closely and accurately, it appears that there is enough room for the 4 or 5 “winners” outlined above. There are as many different types of people, and as varied a range of viewing tastes as there are types of content. All these “winners” have adopted a strategy that should be able to appeal to a critical mass subscription base.

If one were to subscribe to all 5 “winners” above, it would cost $25 a month which, according to the research, is affordable for most households. Even if one were to take the higher priced packages from Netflix and YouTube, and the upcoming Peacock were to go with a subscription fee option, to double this cost to $50, it would still be cheaper than the cost of cable services.

Good bye cable; welcome video streaming!

For business strategy advisory, that will leverage uncommon sense and drive your bottom line, get in touch with us on [email protected]

Follow on: